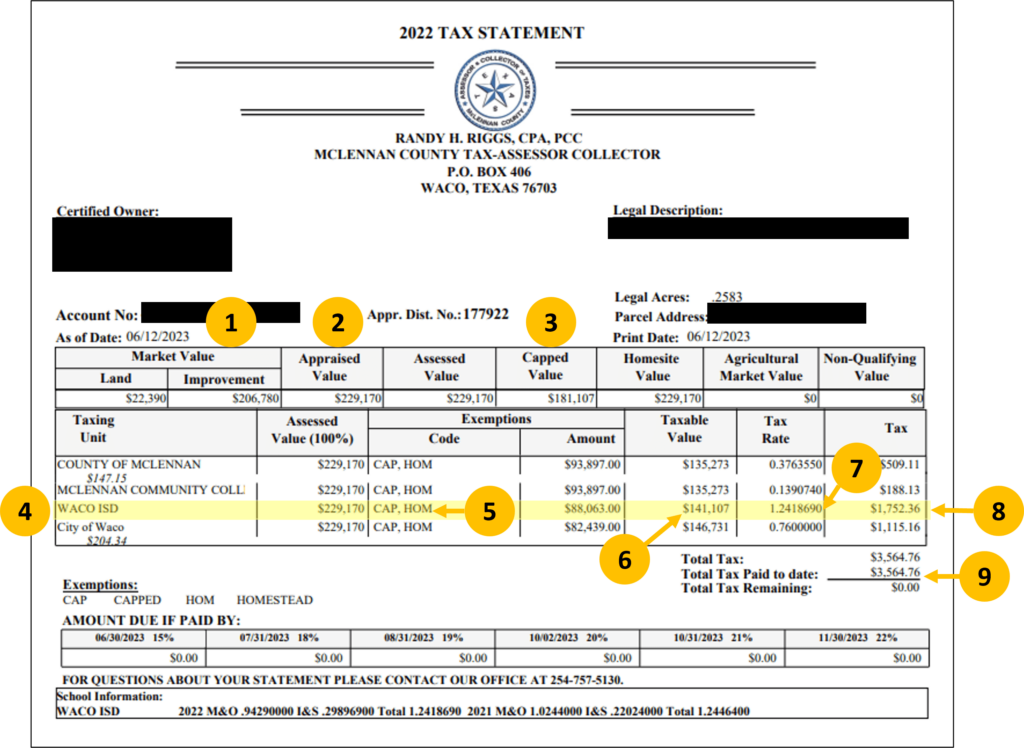

The Great Property Tax Stand-off of 2023, Part 1: Understanding my Property Taxes

By Ashley Bean Thornton

I have been fascinated by the current stand-off between the Texas House of Representatives (and Governor Abbott) and the Texas Senate (and Lieutenant Governor Patrick) regarding property taxes. But honestly, I didn’t know that much about property taxes, so I thought it might be smart for me to learn a little more about it before deciding what I think.

I’ve done a little research and visited with a few folks…and here is what I have learned. I’ve written it up as a guided tour of my most recent property tax bill. I thought I would share it with you just in case, you, like me, haven’t ever really thought about it that much.

My only “property” is the house I live in and the land it sits on – naturally if you have more property, your property tax bill will be more complicated.

1. Market Value – The market value section on my tax bill shows the appraised value of the land plus the value of the “improvements.” In my case the “improvement” is my house.

2. Appraised Value – The appraised value is set by the county appraisal district. It is supposed to be the price at which the property could be sold under prevailing market conditions. According to the tax code, taxable property must be appraised by January 1. For the purposes of my bill, you can see that the appraised value is the market value of the land plus the market value of the improvement (my house). You can also see that, for me, the appraised value, the assessed value, and the homesite value are all the same.

3. Capped Value – You can see that the “capped” value of my house is quite a bit less than the appraised value. That is because, in 1997 Texas voters adopted a statewide homestead appraisal cap of 10% (Tax Code Section 23.23(a)). Since my property is where I live – my “homestead” – my taxable value is only allowed to go up by 10% year over year. We bought our house 20+ years ago for around $60K. Through the years, market value increase has outpaced that 10% limit therefore my capped value is less than my appraised value.

4. Taxing Entities – Our County Tax Assessor-Collector administrates taxes from numerous “taxing entities” including McLennan County, all the different school districts in the county, McClennan Community College, and several city governments. I pay property taxes to support four of those entities: McLennan County, McLennan County Community College, Waco ISD and the City of Waco. For most of the rest of this post, I will focus on Waco ISD (highlighted in yellow.) Each different entity can have different exemptions and different tax rates.

5. Exemptions – For the property taxes I pay to support Waco ISD, I qualify for two exemptions: Cap and Hom. “Cap” is explained in #3 above, capped value. “Hom” stands for “Homestead Exemption.” The state tax code (Tax Code Section 11.13(b) ) requires school districts to provide a $40,000 exemption on homesteads. Disabled people and people over 65 get an additional $10,000 exemption. A Homestead Exemption is a set amount subtracted directly off of your capped value. Changes to the Homestead Exemption are technically changes to the Texas Constitution and have to be placed on the ballot for all of us to approve before they go into full effect.

6. Taxable Value – The taxable value of my house is my capped value minus the amount of the exemptions I receive. For my Waco ISD taxes, that value on this bill is $141,107. $181,107 (capped value) – $40,000 (homestead exemption). You may notice that the taxable value on my bill is different for the different taxing entities. That is because each entity can have a different homestead exemption.

7. Tax rate – The different taxing entities set their own tax rates, and they can all have different tax rates. The rate for Waco ISD on this bill is 1.241869%. Theoretically the rate could change every year. Each taxing entity fills out a tax worksheet each year to figure out what tax rate they will use. If you scroll to the end of the worksheet you will see a “No-New-Revenue (NNR) tax rate” and a “Voter-approval tax rate.” The NNR rate is an estimate of the rate the school district would have to charge to bring in roughly the same revenue as the previous year – taking into account changes in property values and other changes. The “Voter-approval” rate is the highest rate the school district can use without having to put it up for a vote. The school district may propose any rate from the NNR rate up to and including the Voter-Approval rate.

8. Taxes owed for Waco ISD – This is my taxable value for Waco ISD times the Waco ISD Tax rate. In this case $141,107 (WISD taxable value) X 1.241869% (WISD tax rate) = $1752.36. That is what I owe for the Waco ISD part of my property taxes.

9. Total property taxes – My total property taxes are the sum of the taxes owed to each of the four different taxing entities.

[…] Abbott) and the Texas Senate (and Lieutenant Governor Patrick) regarding property taxes. In my last blog I took a little time to understand my property tax bill. In this post I am attempting to explain […]

[…] and the Texas Senate (and Lieutenant Governor Patrick) regarding property taxes. In the first post of this series I took a little time to educate myself about my own property tax bill. In the second post, I […]